CONNECTICUT

Home Sales Up, Average Price Up

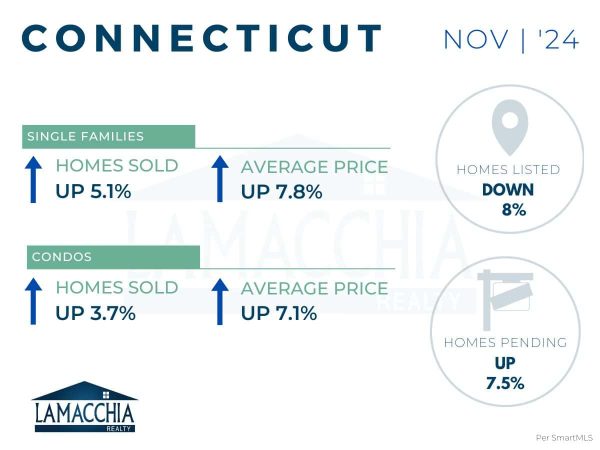

Home sales are up 4.8% year over year, with November 2024 at 2,869 compared to 2,738 last November. Sales are up across all categories

- Single families: 2,111 (2023) | 2,219 (2024)

- Condominiums: 627 (2023) | 650 (2024)

The average sale price has increased by 7.8% compared to last year, now at $540,683 from $501,408. Prices increased for all categories.

- Single families: $553,944 (2023) | $597,105 (2024)

- Condominiums: $324,844 (2023) | $348,070 (2024)

Homes Listed For Sale:

The number of homes listed is down by 8% when compared to November 2023.

- 2024: 2,536

- 2023: 2,756

- 2022: 2,616

Pending Home Sales:

The number of homes placed under contract is up by 7.5% when compared to November 2023.

- 2024: 2,808

- 2023: 2,612

- 2022: 2,843

Data provided by SmartMLS then compared to the prior year.

What’s Happening in the Market?

- In November 2024, national home sales climbed 6.1% compared to a year ago, marking the biggest year-over-year gain since June 2021. Following this trend, Connecticut also saw an increase in home sales.

- The Connecticut market is busy this holiday season! Even with fewer homes being listed—likely due to the busy time of year—buyer demand remains strong. Home prices and pending sales are both on the rise, showing the market’s continued competitiveness. Sellers, this could be a prime time to list your home!

- According to Mortgage Daily News, mortgage rates in November, dropped from about 7% to 6.8% by month’s end. However, rates began climbing again in December, peaking at 7.14% on the 19th.

- As we approach the new year, many of us are setting goals. Buying a home can feel intimidating, but don’t let it stop you! We’re here to help make this process smooth and stress-free for you! Let’s turn your homeownership dreams into reality in 2025!

- Great news for homebuyers! In 2025, the FHFA is increasing the conforming loan limit to $806,500—up $40,000 from 2024. Despite market challenges, constrained inventory and high demand continue to drive prices up. This change helps buyers access higher loan amounts to keep pace with rising home values.

As we navigate the adjusting market and the impact it’s having on buying, selling, renting, and homeownership, being informed is one of the first steps in knowing what to do next. Click on the button to visit the CT Real Estate Updates page and never hesitate to contact us with questions.

Instant Home Evaluation

Additional Resources

November 2024 Rhode Island Housing Report

RHODE ISLAND Home Sales Down, Average Price Up Home sales are down 0.6% year over year, with November 2024 at 818 compared to 823 last

November 2024 Rhode Island Housing Report

RHODE ISLAND Home Sales Down, Average Price Up Home sales are down 0.6% year over year, with November 2024 at 818 compared to 823 last