NEW HAMPSHIRE

Home Sales Down, Average Price Up

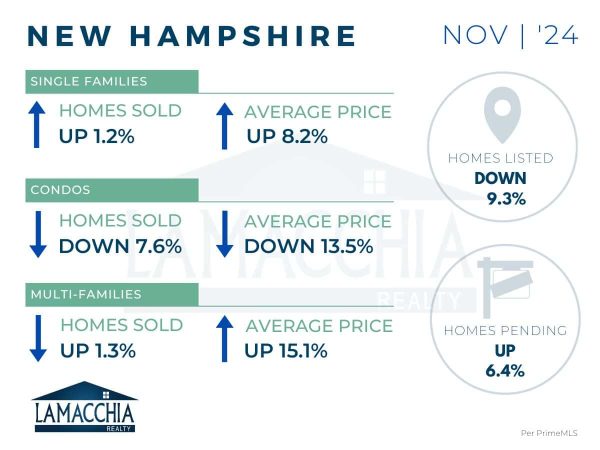

Home sales are down 1% year over year, with November 2024 at 1,469 compared to 1,455 last November. Sales are up for single-family homes and down for multi-family homes and condos.

- Single families: 1,047 (2023) | 1,060(2024)

- Condominiums: 342 (2023) | 316 (2024)

- Multi-families: 80 (2023) | 79 (2024)

Average sale price increased by 4.1% when compared to last November, now at $569,836. Prices increased for Single and Multi-family homes and decreased for Condos.

- Single families: $558,496 (2023) | $604,560 (2024)

- Condominiums: $532,461 (2023) | $460,780 (2024)

- Multi-families: $469,320 (2023) | $540,144 (2024)

Homes Listed For Sale:

The number of homes listed is down by 9.3% when compared to November 2023.

- 2024: 1,174

- 2023: 1,294

- 2022: 1,231

Pending Home Sales:

The number of homes placed under contract is up by 6.4% when compared to November 2023.

- 2024: 1,390

- 2023: 1,307

- 2022: 1,327

Data provided by PrimeMLS then compared to the prior year.

What’s Happening in the Market?

- In November 2024, national home sales climbed 6.1% compared to a year ago, marking the biggest year-over-year gain since June 2021. Despite this trend, New Hampshire saw a decrease in home sales.

- The New Hampshire market remains active this holiday season! With fewer homes being listed—likely due to the busy time of year—buyer demand is still strong, as seen in the rise of pending sales. While overall home sales are down, homes that are listed are still selling quickly. Sellers now could be the perfect time to list your home!

- According to Mortgage Daily News, mortgage rates in November, dropped from about 7% to 6.8% by month’s end. However, rates began climbing again in December, peaking at 7.14% on the 19th.

- As we approach the new year, many of us are setting goals. Buying a home can feel intimidating, but don’t let it stop you! We’re here to help make this process smooth and stress-free for you! Let’s turn your homeownership dreams into reality in 2025!

- Great news for homebuyers! In 2025, the FHFA is increasing the conforming loan limit to $806,500—up $40,000 from 2024. Despite market challenges, constrained inventory and high demand continue to drive prices up. This change helps buyers access higher loan amounts to keep pace with rising home values.

As we navigate the adjusting market and the impact it’s having on buying, selling, renting, and homeownership, being informed is one of the first steps in knowing what to do next. Click on the button to visit the NH Real Estate Weekly Updates page and never hesitate to contact us with questions.

Instant Home Evaluation

Additional Resources

November 2024 Rhode Island Housing Report

RHODE ISLAND Home Sales Down, Average Price Up Home sales are down 0.6% year over year, with November 2024 at 818 compared to 823 last

November 2024 Rhode Island Housing Report

RHODE ISLAND Home Sales Down, Average Price Up Home sales are down 0.6% year over year, with November 2024 at 818 compared to 823 last